Our views

As a Canadian-based integrated energy company with oil and natural gas production in Canada and the Asia Pacific region, and upgrading, refining and marketing operations in Canada and the United States, we offer perspectives on a range of topics related to our industry, and are committed to being a factual, active and constructive voice. Review our positions on key issues and public policies to learn more about what matters to us and our stakeholders.

Our views on key issues

-

Climate change

- Cenovus shares the world’s concerns about climate change and greenhouse gas emissions. Oil and gas companies need to be a part of the solution.

- Addressing climate change is essential, and it has to be done in a way that preserves the strength of the Canadian economy and Canadians’ long-term access to secure supplies of affordable energy.

- Cenovus is a founding member of the Pathways Alliance, which, with Canadian Natural Resources, ConocoPhillips Canada, Imperial, MEG Energy and Suncor Energy, represents the six largest oil sands producers in Canada, operating 95% of oil sands production.

- Pathways is focused on advancing environmental innovation and projects, including carbon capture and storage.

-

Continued role of oil and natural gas

- People around the world will continue to need access to a secure, diversified mix of affordable and reliable energy, including responsibly produced oil and natural gas.

- Oil demand scenarios vary, with projections showing differing rates of decline or even stability over the decades. However, all credible reports show oil and gas maintaining a key position in the global energy mix well into the future.

- Hydrocarbons, the primary components of oil and natural gas, have a wide range of uses. This includes jet fuel for aircrafts, diesel fuel for trucks, gasoline for vehicles and natural gas to heat homes. They are also essential for producing clothes, asphalt for paved roads, fertilizer to grow food, plastics (used in products including smartphones, contact lenses and computers), carbon fibre products for lighter aircraft and electric vehicles, and other innovative products that will help drive lower emissions.

- As emerging countries improve their standard of living, demand for these types of products is expected to increase, further driving global demand for responsibly produced oil and natural gas.

- The Canadian energy sector has a critical role in the transition to a lower carbon economy within Canada. The sector also has a tremendous opportunity to help ensure global energy security by supplying responsibly produced oil and natural gas, helping to displace oil from less democratic jurisdictions.

- Geopolitical instability continues to highlight the importance of energy security. Canada is well-positioned to provide reliable and affordable oil and natural gas.

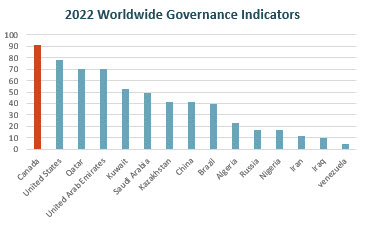

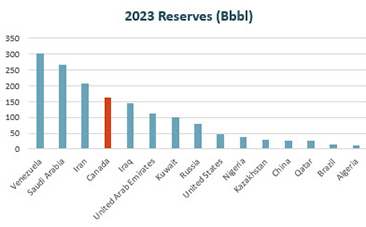

- Since oil and gas will continue to play a key role in meeting the world’s growing demand for energy, it is critical that these resources come from jurisdictions like Canada that have a track record for responsible production, transparency, a stable democracy and strong regulatory systems.

Canadian oil should be the preferred barrel

-

Indigenous reconciliation

- We recognize our responsibility to support reconciliation with Indigenous peoples. Our approach to working with Indigenous communities focuses on relationships built on trust, respect and mutual benefit. We also believe one of the most important ways we can support reconciliation is through economic inclusion. Learn more here.

Our public policy positions

We actively monitor and evaluate public policy developments that impact our industry. We work constructively with all levels of government to seek sensible policy solutions that ensure a strong business environment and align with our corporate objectives, strategy, and environmental, social and governance (ESG) approach. While Cenovus is affected by numerous public policy issues at the national, regional and local levels, we have taken a public position on the issues outlined below as we currently deem them the most impactful to our company.

Our current positions on Canadian policy

-

Bill C-59 (Greenwashing Provisions)

- Changes to Canada’s Competition Act, which were passed without any transition period, guidance or meaningful consultation, have created significant uncertainty and risk around how Canadian businesses can talk publicly about their environmental actions and performance. Along with the increased potential for frivolous litigation, companies now face significant financial penalties unless they can prove their environmental representations are based on “adequate and proper substantiation” - terms which are vague and open-ended - and in accordance with an undefined set of “internationally recognized” methodologies, which in many cases may not exist. This new standard of proof is overly broad and ambiguous, resulting in unintended consequences to areas of environmental performance reporting that are outside the mandate of the Competition Bureau.

- We firmly stand by the ongoing environmental actions we’re taking, the accuracy of our reporting and the information we’ve shared to date about our environmental performance. To the extent the Competition Bureau can provide clarity through specific guidance about how these changes to the Competition Act will be interpreted and applied, that will help guide our future communications about the environmental work we are doing.

-

Carbon pricing

- Cenovus is currently exposed to carbon pricing on its upstream and downstream production in Canada.

- We are the only top 10 global oil producer that burdens its industry with a carbon price. Other countries have incentivized decarbonization efforts rather than penalized their businesses, which is necessary to achieve decarbonization at scale without compromising our economic prosperity.

- Carbon pricing can be effective when it is applied equitably on a global scale. When this is not feasible, a price framework may be used, provided it does not compromise the affordability, reliability, abundance and security of energy supplies, nor the international competitiveness of heavily trade-exposed sectors, such as oil and natural gas.

- Cenovus believes companies should be able to use carbon compliance fees to offset the costs of building and operating carbon reduction projects. This approach ensures the carbon price signal is maintained while enabling efficient capital allocation to carbon reduction initiatives in the sector.

- Canadian oil producers are in competition with global producers, from jurisdictions where carbon pricing does not apply. Onerous carbon pricing regulations undermine Canada’s international competitiveness. Investment dollars, production capacity, jobs and resource revenues move to lower-cost jurisdictions, many of which don’t have the same level of transparency, or stringent environmental regulations or ambitions as Canada.

- A viable, competitive energy industry in Canada is essential to supporting the economy, providing jobs, and ensuring energy security and affordability for Canadians and other markets we serve, while also reducing emissions.

-

Methane regulations

- Canada was one of the first countries in the world to regulate methane emissions from the oil and gas sector at the national level. It is also the first country to commit to developing a plan that includes regulations requiring at least a 75% reduction by 2030, compared to 2012 levels.

- While we support the commitment to reduce methane emissions from the oil and gas sector, it is crucial to design and implement practical and achievable regulations, supported by impactful early-action incentive programs.

- Provinces are best suited to regulate oil and gas operations, including methane emissions, and we support the provinces maintaining that regulatory authority.

- The proposed federal methane regulatory amendments create a strong possibility that the cost burden, level of ambition, pace of implementation, and lack of viable technological solutions and trained resources will make compliance technically and economically unachievable.

- Given the federal government’s position that federal emissions policy should not be designed to compel the shut-in of production, Cenovus will work with the government to help it calibrate policy in a way that achieves significant methane reduction without the unintended consequences of lost production. We need methane emissions policies that are realistic, achievable and focused, without compromising health and safety or production.

-

Oil and gas emissions cap

- Cenovus believes this legislation, if passed as presented, will lead to a reduction in the production of oil and gas in Canada despite the proposed compliance flexibilities.

- The proposed emissions cap regulations fail to provide industry with any clarity regarding emissions limits and compliance options beyond the first compliance period of 2030-2032. Coupled with uncertainty regarding carbon pricing beyond 2030, we lack the policy stability and certainty required to make multi-billion-dollar investments.

- It is important to not just look at what might be technically achievable, but to also understand whether the target is economically achievable without putting Canadian businesses at a competitive disadvantage to the rest of the world.

- Shutting in production in the world’s fourth-largest oil and gas producing nation will have a negative impact on the entire Canadian economy, result in a potential trade imbalance and degrade Canada’s already struggling productivity.

- Oil and natural gas are by far Canada’s largest exports. By effectively curtailing production, the emissions cap will result in Canada running an enormous merchandise trade deficit. This in turn could further weaken the Canadian dollar and increase the costs for imported goods like clothing and fresh produce.

- This punitive legislation puts Canada out of step with other oil producing nations like the United States. Our largest trading partner has taken the opposite approach and focused on an incentive-based approach, further strengthening the U.S. economy.

- This is drastically different than what industry continues to experience in Canada. In Canada, limited opportunities for government support of decarbonization are complex and uncertain. The provisions contained in the investment tax credit (ITC) for the capital costs of carbon capture create further uncertainty and risk for companies, and access to the full ITC has an unrealistically short timeline.

-

Clean Fuel Regulations

- Canada’s Clean Fuel Regulations (CFR) came into effect in July 2023, replacing the federal Renewable Fuels Regulation. The policy sets increasingly stringent requirements on fuel producers and importers to reduce the lifecycle carbon intensity of liquid fuels used in Canada, supporting the production of cleaner fuels, including cleaner fossil fuels and lower carbon intensity biofuels.

- The policy requires suppliers of liquid fossil fuels (gasoline and diesel) to gradually reduce over time the carbon intensity – or the amount of emissions – from the fuels they produce and sell for use in Canada, leading to a decrease of approximately 15% (below 2016 levels) in the carbon intensity of gasoline and diesel used in Canada by 2030. Where carbon intensity reductions are not achieved, offset credits may be used.

- The CFR intends to achieve a target reduction of 30 million tonnes of annual greenhouse gas emissions by 2030, contributing significantly to Canada's goal of reducing national emissions by 30% below 2005 levels by the same year.

- According to a May 2023 analysis by the Parliamentary Budget Officer, these regulations could increase the cost of gasoline by up to 17 cents per litre and diesel fuel by up to 16 cents per litre when fully implemented by 2030.

- The CFR was initially drafted to allow the generation and sale of emissions credits for all upstream carbon capture and sequestration (CCS) projects, which could have significantly improved the economics of Canadian carbon capture projects. However, the government later excluded any projects associated with oil exports – approximately 80% of Canadian oil production – from eligibility. Cenovus has recommended that this exclusion be lifted and the eligibility criteria be simplified so that emissions reductions from any CCS-produced barrel can generate a credit.

-

Clean Electricity Regulations

- Cenovus believes that, as currently drafted, the Clean Electricity Regulations (CER) do not adhere to the federal government’s stated core principles: maximizing greenhouse gas emissions reductions from the grid, maintaining electricity affordability for Canadians and businesses, and maintaining grid reliability to support a strong economy.

- We agree that emissions reductions in the electricity sector are needed, but they must be done in a way that preserves the reliability and affordability of the grid. The makeup of provincial power generation fleets is largely a function of geography. The proposed regulations do not reflect the unique challenges faced by provinces without hydroelectric capacity or large-scale nuclear facilities, such as Alberta, Saskatchewan and Nova Scotia. Under the current framework, these provinces would be required to overhaul upwards of 70% of their power generation capacity by 2035. They would also require significant power transmission buildouts, as well as increased electrical transmission systems to transfer power between neighbouring provinces.

- The proposed regulations aim to drive Canadian power generation to near-zero emissions by 2035, largely through the implementation of an extremely stringent performance standard beginning on January 1, 2035. Natural gas facilities would be required to install carbon capture facilities capable of capturing over 90% of emissions or switch to low carbon hydrogen (produced either with renewable power or using carbon capture) to continue operating. Additionally, the use of coal for power generation will be prohibited.

- Peak generation units, which are critical backup for intermittent renewables like wind and solar, will have their operations sharply curtailed and will likely be rendered uneconomic. This will serve as an impediment to renewable buildouts while undermining grid stability.

- Electrification is one of the key avenues for decarbonizing modern economies. Forcing a rushed overhaul of existing power generation facilities, the government risks compromising the economics of electrification (i.e., moving to electric vehicles), and power-intensive decarbonization projects like carbon capture, while limiting the ability of grids to grow sufficiently to meet demand.

- We are concerned that the CER will be a major impediment to investments in the power grid due to a lack of operational flexibility, an excessively stringent performance standard with minimal compliance flexibility, and the potential for protracted legal challenges.

- We also have concerns about risks to the broader economy and the likelihood that vulnerable Canadians will be hard-hit by soaring power bills at a time when household budgets are already stretched to their limits.

-

Impact Assessment Act

- The Canadian Impact Assessment Act (IAA) is the legislative framework that governs how the federal government assesses the impacts of designated projects, including those on federal lands. The Impact Assessment Agency of Canada leads these assessments.

- The Alberta government challenged the constitutionality of the IAA and in October 2023 the Supreme Court of Canada (SCC) ruled that parts of the IAA are unconstitutional. The majority of the Court (5-2) ruled that the IAA's provisions addressing the assessment of "designated projects" exceeded federal legislative authority, as they regulate projects in their entirety rather than limiting the assessment to areas within defined federal jurisdiction.

- In June 2024, the federal government amended the IAA to comply with the direction of the SCC. However, the proposed amendments do the minimum to address the most significant concerns identified by the SCC. The amendments enable:

- An expanded role for agreements with provinces and other jurisdictions to coordinate environmental assessments.

- Partial substitutions accompanied by cooperation agreements to ensure federal aspects of a project’s impacts are assessed in the provincial process.

- While these provisions have the potential to enable more reliance on processes led by local jurisdictions, including the provinces and Indigenous governments, implementation and certainty for proponents will depend on the extent to which federal authorities can reach agreements regarding the scope and procedure for impact assessments.

- Moreover, the federal government has yet to finalize key regulations impacting the sector – including designated projects.

- Cenovus believes that in-situ facilities and fossil-fuel-fired power plants should be excluded from the IAA project list, as these types of facilities fall within the purview of the provinces. We also believe the Act should be further amended to remove ministerial approval authority upon completion of the assessments. The process should also be streamlined by frontloading objection timelines and more narrowly defining who has standing to object/intervene in the process to include those stakeholders that are effectively directly and adversely affected.

-

Investment tax credit

- In Canada, the federal government has proposed using Investment Tax Credits (ITC) as a strategic financial tool to promote private sector investment in certain technologies and projects that contribute to the government’s climate ambitions. These credits allow businesses to offset a portion of their capital investment costs in areas such as renewable energy, energy efficiency, carbon capture and low-emissions technology.

- Canada’s Carbon Capture, Utilization and Storage (CCUS) ITC proposes to refund a percentage of “eligible equipment” costs until 2030, with the benefit declining afterward. The CCUS ITC can be applied to cover 60% of eligible carbon capture equipment used in Direct Air Capture, 50% for upstream carbon capture equipment, and 37.5% for eligible transportation, storage and carbon use equipment. After 2030, the ITC rates will be reduced by half. The CCUS ITC excludes operating costs, a significant expense for CCUS projects. It also excludes the use of CO2 for enhanced oil recovery, which in the United States has provided stable revenue to offset the costs of nearly all existing CCUS projects. The eligibility period for the full ITC benefit should also be extended beyond 2030 for the benefit of all CCUS projects, no matter when they are constructed.

- Other oil and gas nations leading on carbon reduction initiatives provide significantly more support than Canada for both capital and operating costs, and they provide it in a simpler-to-access manner that reduces funding risk. Their incentive structures are also available for longer periods which reflects a more realistic understanding of the high costs and years required to plan, design, permit, sanction, finance, procure, construct and certify large infrastructure projects. This puts Canadian projects at a significant economic disadvantage relative to global equivalents.

- While Cenovus supports Canadian government efforts to incentivize investment into much needed CCUS technology, the definition of “eligible equipment” is unclear and the relatively short period the full ITC will be available is also a risk.

- Cenovus advocates for carbon reduction capital and operating funding support through tax credits at a level competitive with leading oil and gas producing nations that are tackling the emissions challenge.

-

Indigenous access to capital

- Economic reconciliation provides an important opportunity for corporations to support meaningful inclusion of Indigenous peoples who live near our operations. Learn more about Cenovus’s Indigenous reconciliation targets and progress.

- The federal government recently announced an Indigenous loan guarantee program, and Alberta created the Alberta Indigenous Opportunities Corporation to support Indigenous investment in the economy.

- At Cenovus, we believe access to competitively-priced capital is critical to increasing Indigenous participation and investment in the economy. It is important that Indigenous peoples determine which investments make the most sense for their communities or businesses.

Read the open letter sent to the leaders of Canada's political parties, advocating for Canada to defend its economic sovereignty and competitiveness through the energy industry.

Follow us on social media to hear more of our views from our experts: